Introducing: The Funding Zone™

The FRA™ helps you identify which Funding Zone™ your business is operating in: Growth, Stuck, or Drowning. Each zone calls for a different next step.

- Growth: expanding — the goal is to scale strategically with the right capital.

- Stuck: stable — but momentum is limited by cash flow or bottlenecks.

- Drowning: under pressure — stabilization comes before growth.

This doesn’t label you — it identifies the zone your business is in right now, so you can make the right move with confidence.

Cash flow issues are one of the leading reasons small businesses struggle.

A U.S. Bank study found that 82% of small businesses fail due to cash flow problems. Many owners don’t realize their funding structure may be contributing to hidden strain — which is why checking your funding readiness matters.

Source: SCORE summary of U.S. Bank Small Business Study

“I just love waiting 3–6 months,

pledging collateral, and getting denied

by a bank —

said no small business owner ever!

”

See Your Funding Options —

Before You Apply Anywhere

Most business owners think they need a bank loan — when what they really need first is clarity. The Biz Fund Ready Check shows how fundable your business actually is, where you stand with lenders, and what (if anything) needs to improve — so you can move forward with confidence.

Start My Free Funding Readiness Check

Start My Free Funding Readiness Check

How It Works

In less than 5 minutes, you’ll receive a personalized funding snapshot that shows where your business stands — and what to improve before applying anywhere.

1. Answer 18 Focused Questions

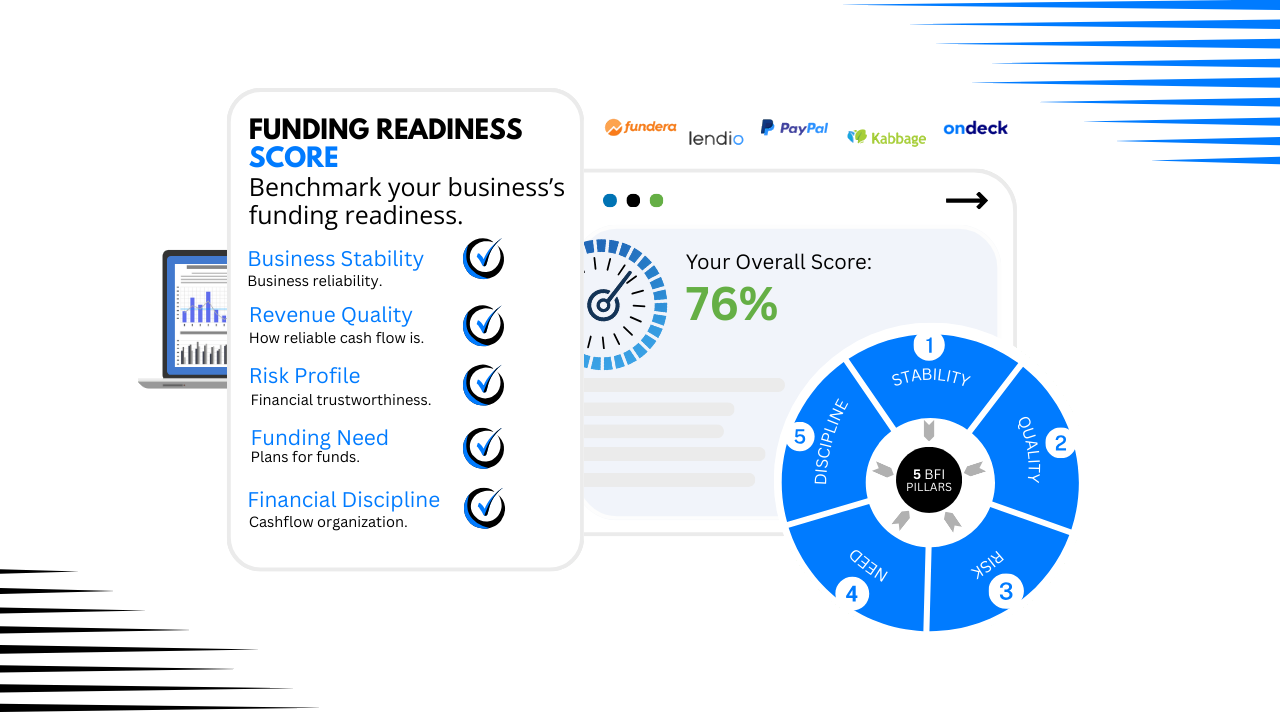

The Biz Fund Ready Check evaluates five essential areas lenders look at — the same factors that influence approval odds, funding amounts, and terms.

2. Receive Your Funding Readiness Score

Instantly see your overall Biz Fund Ready Score, plus insights into each category so you understand exactly where you’re strong — and where you’re not.

3. Get a Clear Action Plan

You’ll receive a customized roadmap showing how to strengthen your funding profile, improve approval odds, and position your business for better offers.

No cost. No obligation. Instant results.

Unlock better funding opportunities with our assessment.

Copyright © 2024 1800BizFunds. All Rights Reserved.